is property transfer tax included in mortgage

Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any outstanding. Your mortgage company may pay your annual property taxes for you through your mortgage agreement.

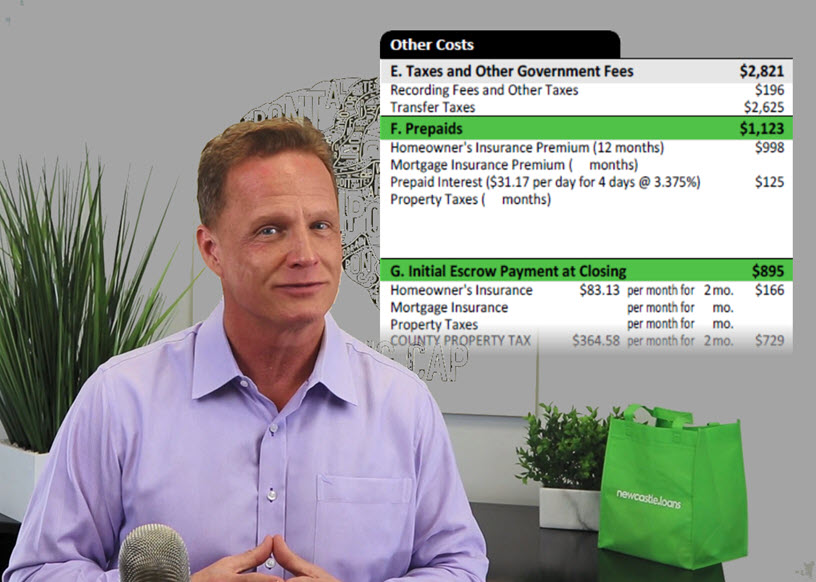

Prepaid Items Mortgage Escrow Account How Much Do They Cost

1 of the fair market value up to and.

. The general property transfer tax rate is. Land buildings furniture and fixtures transportation equipment machinery and other equipment and inventories. Include the following types of property.

The general property transfer tax rate is. Your lawyer or annotator is in. In Alabama the real estate transfer tax rate is 050 per 500 of the purchase price or 01 and officially records the transfer of the deed.

Property taxes are included as part of your monthly mortgage payment. General property transfer tax. 1 of the fair market value up to and including 200000.

If you qualify for a 50000. Property tax is included in most mortgage payments. Although the Property Transfer Tax may not.

And when the economy is doing well home. Can Property Transfer Tax Be Added To Mortgage Bc. 1 if the first 200000 of the propertys fair market value plus 2 of the value portion between 200000 2000000 plus 3 tax on the portion above 2000000 Lets look at an example.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. 2 of the fair market value greater than 200000 and up to and including 2000000. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes.

In most cases if youâre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. In this case expect to pay a total of 025 per 100 in taxes and. The general property transfer tax applies for all taxable transactions.

Buyers are required to pay NYC 05 mortgage recording tax on their first mortgageIf the loan is less than 500000 it will be charged 8 and if it is more than. If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on the. With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a.

There are two primary reasons for this. Property Transfer Taxes are an upfront cost and they are not included in your mortgage. Although the Property Transfer Tax.

In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. Further for all other types of transfers in Miami-Dade County there. When you pay property taxes along with your mortgage payment your lender deposits your property tax payment into an escrow account.

Include only property that is. If you are the buyer and you pay them include them in the cost basis of the property. When your property taxes are due.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

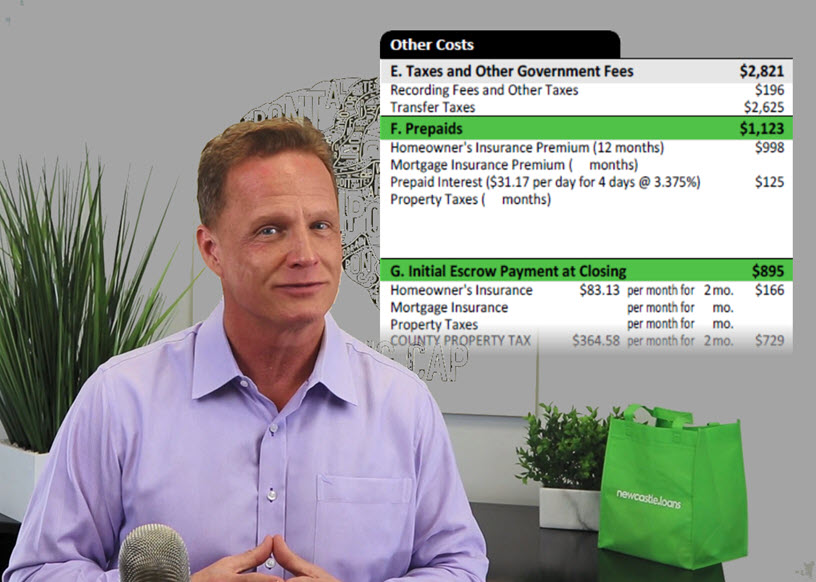

Tp 584 Form Fill Out And Sign Printable Pdf Template Signnow

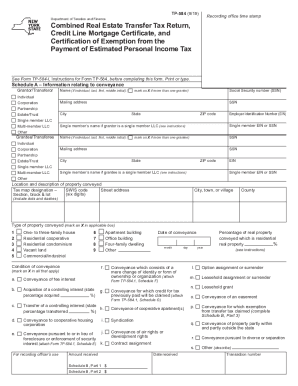

The Mortgage Porter Good Faith Estimate Part 5 Your Charges For All Other Settlement Services

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Form Tp 584 3 07 Combined Real Estate Transfer Tax Return

Transfer Tax Exemption Archives Get Fha Va Usda Mortgage Rates And Tips Prmi Delaware

Real Estate Transfer Tax Return Schedule Of Apportionment Tp 584 6 Nyc Pdf Fpdf

Property Transactions Sales Mortgage Data Attom

Understanding California S Property Taxes

What Are Real Estate Transfer Taxes Forbes Advisor

How To Read A Monthly Mortgage Statement Lendingtree

What Are Transfer Taxes Mansion Global

How To Calculate Land Transfer Tax Mortgage Math 6 With Ratehub Ca Youtube

Alabama Property Tax H R Block

Mansion Tax Adds To Array Of Transfer Taxes When Buying Selling Real Property Marks Paneth

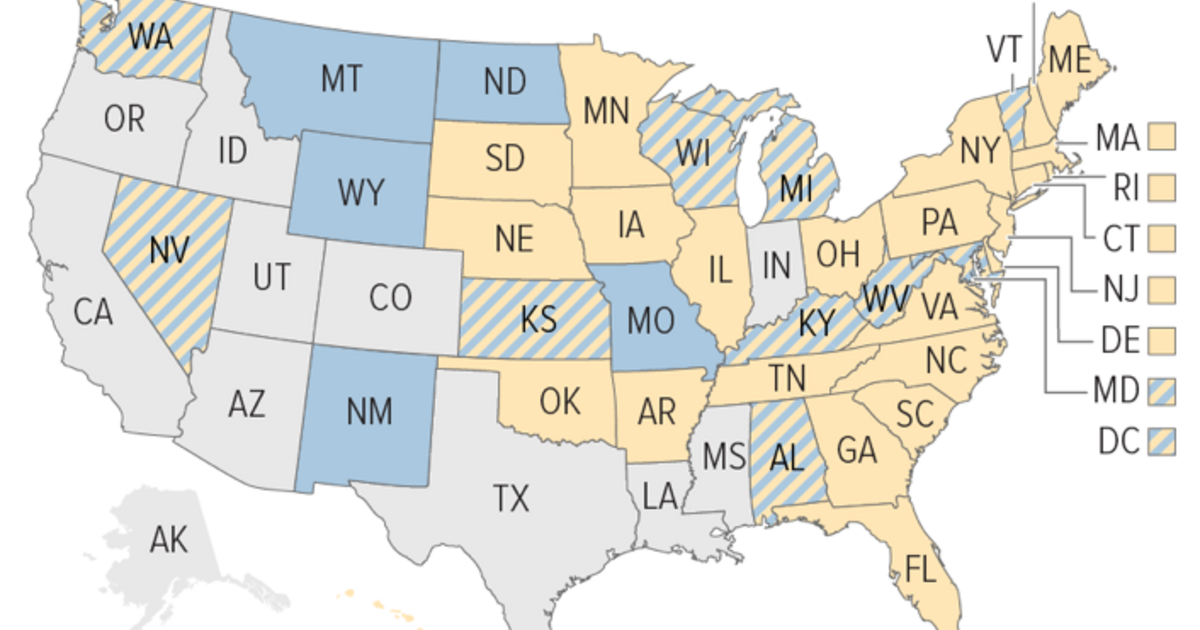

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities